The Film Industry in Its Greatest Crisis Yet?

A Global Slowdown

The industry is in deep crisis — maybe the biggest we’ve ever seen.

Major companies like Panavision and ARRI are struggling, and smaller ones like Transvideo have already gone under. Many of us who work in or around the business are asking: Where do we go from here?

I think it’s the result of many overlapping factors over the last five or six years — and it all started with COVID.

COVID: The Beginning of the Shift

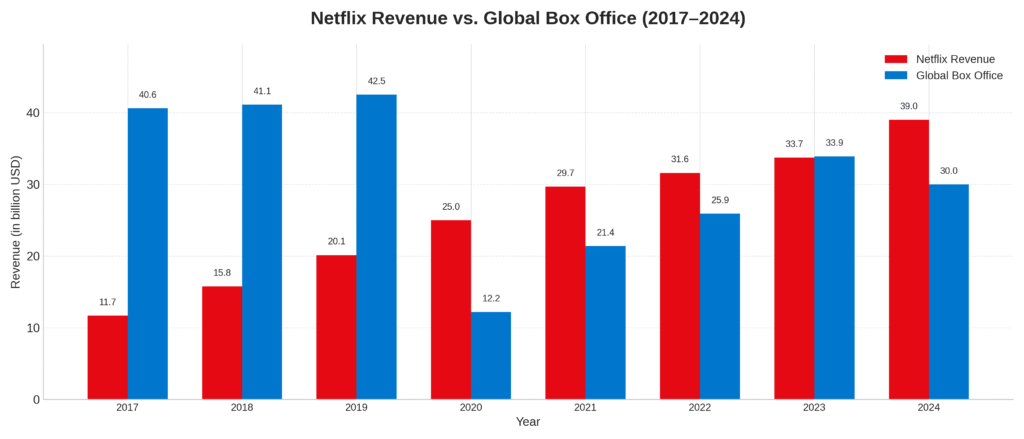

In 2020–2021, Netflix nearly doubled its revenue, while the global box office was cut in half.

Streaming became a direct threat to the traditional studios. Disney, Paramount, and Warner quickly launched their own platforms.

But while Hollywood’s cinema market collapsed, something different happened.

At first, production stopped — then it exploded again, in a completely new way:

online events, virtual conferences, streamed presentations.

I worked here in Germany on countless virtual events for Audi, BMW, and others — not webcam setups, but full productions with Steadicams, SuperTechnos, and massive LED walls.

All for MS Teams meetings.

These were internal corporate events — for finance, design, or management departments — where normally hundreds of managers from all over the world would have been flown in.

During COVID, that was impossible. And big companies don’t have just one department like that — they have many, each with its own major events and budgets.

Before COVID, these were live gatherings. The money went into flights, hotels, catering.

Now, that same money was redirected into high-end online productions — sometimes with OB trucks, 15 cameras, full stage and lighting setups.

The Streaming Rush

Then came the global hunger for content.

Every country launched its own Netflix, Apple, or Paramount shows.

Virtual studios boomed. Advertising followed.

Work everywhere.

Everyone thought: This is the new golden era.

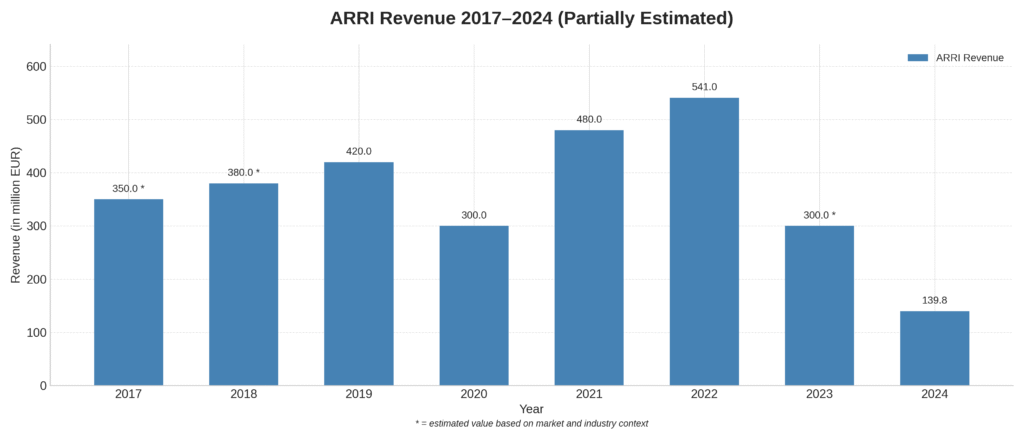

Manufacturers like ARRI, RED, and Panavision ran at full speed.

Rentals ordered 15 new Alexas at a time.

ARRI made around €54 million profit in 2022 — compared to 10–15 million in normal years.

Then came the usual trap:

“Next year we’ll do even better!”

The industry inflated itself — until it burst.

After the Boom: The Hard Fall

After the post-COVID rush came the crash.

Netflix, Disney, and Amazon realized growth had stalled.

Production froze. Budgets were slashed. Jobs disappeared.

Production stops. Budget cuts. Layoffs.

Hollywood produced about 30 % fewer projects in 2023 than in 2022. Europe followed.

This content recession hit everyone — camera operators, rentals, post houses, manufacturers.

Then came the strikes, the war in Ukraine, energy costs, inflation.

The result: stagnation.

Maybe it wasn’t a total collapse — maybe it was just a return to normal.

But by then, too many people, too much gear, and too little work.

The AI Shockwave

Then came the next hit: AI.

In early 2022, Runway appeared — at first just a toy.

Then came Sora, Veo, and others.

Today we’re seeing the first major commercials created entirely with AI.

No crew, no cameras, no rentals.

New job titles appeared out of nowhere:

AI Producer · Prompt Designer · GenAI Director · Model Trainer · Post-AI Compositor.

It’s a revolution — but for people working in real production, it’s also a threat.

Every AI-generated spot means fewer shoots, smaller teams, less need for stabilization systems, cameras, and crew.

To be honest: Writing this blog would have been a lot harder without my ChatGPT.

And maybe that’s the most honest example of what’s happening — we’re all already part of this change, whether we like it or not.

Oversupply and Price Collapse

The market is oversaturated.

There are more Steadicam, Trinity, and Gimbal operators than ever — but less work.

At the same time, the used gear market is flooded.

High-end equipment, barely used, is being sold far below value — and still sits unsold.

That old safety net — “if it gets bad, I’ll just sell a few pieces of gear” — doesn’t work anymore. Even when you slash prices, it takes months to sell. The price drop on arms, rigs, and even Trinity 2 systems is shocking.

For manufacturers, it’s a nightmare. They spent the boom years designing and building brilliant but expensive new gear. Now they have to make that investment back in a market that’s dried up. Some won’t survive that.

No Digital Savior This Time

Back in 2008–2010, after the financial crisis, came the digital revolution: new cameras, new workflows, new growth.

This time AI isn’t creating expansion — it’s replacing it.

The bread-and-butter commercial work that carried us through the year is fading away.

Real shoots will continue, of course.

People still want real faces, real light, real stories.

But there will be fewer of them, smaller crews, tighter budgets.

Conclusion

This isn’t just another dip — it’s a structural shift. The golden years of packed shooting schedules, endless content, and overbooked rentals are gone.

Maybe that’s not the end of the world — maybe it’s the painful correction we all needed. But it forces everyone to rethink their place in this new landscape. Whoever wants to survive will have to find where real creativity, craftsmanship, and technical skill still have value — despite AI, shrinking budgets, and an oversaturated market.

Because that’s the one thing machines can’t replace. Not yet.

Afterword

How do we move forward?

Maybe only if we start talking to each other again — and stop working against one another.

We all love this craft; otherwise, we’d be doing something else by now.

And after every low, there’s always another rise. Always.

Very nice article!